Category: Longform

You are viewing all posts from this category, beginning with the most recent.

Closed Systems

I feel like I’ve mostly made my peace with closed systems. There are definite advantages to owning your digital life where possible, however . These very words are written on my own personal blog, whose domain I own. I’m also all in on the Apple ecosystem, and I buy into other systems as well. For the most part my digital life lives are in harmony, but on occasion the reminder comes about that I don’t actually own a lot of my things I pay for and that fact can be uncomfortable.

I pay an annual subscription for budget tracking software to Quicken called Simplifi. I’ve been at it for 3 years now (I’m reminded of this because it just renewed this week). Having used the same service for years I’ve got a lot of historical data and it’s fun to see my spending and earning fluctuate month to month and year to year. This is especially powerful since my income is variable being a commissioned Mortgage Lender.

This week shortly after my subscription renewed, my main credit card that most of my spending is ran through disconnected from the service. This isn’t unusual, usually when there is some kind of security or policy change the logins will have to be renewed, I don’t have a problem with this. The problem arrives when I went in to refresh the login. Either the process changed or I clicked somewhere I hadn’t before. Whichever the case, I ended up duplicating my most heavily used credit card and in so doing every transaction that has been made on that credit card was duplicated within Simplifi’s system.. for the entire history I’ve used the service.

Concerning… but also easily fixable right? Just delete the duplicate credit card entry! Well, I did that and apparently I deleted my original login, and in so doing I undid every bit of sorting that I had ever done in the last 3 years of being on this service. Every single month’s spending history was now incorrect. The total I spent still was right, but all the categories were wrong. I reached out to customer service but all I got was a shoulder shrug emojI.

Historical data isn’t the end of the world, I can fix it going forward and all of my rules and sorting will be correct going forward. However, a huge value of having been on the same service for years is now lost and there is no getting it back. This one doesn’t have a satisfying end because I don’t have a good solution, I don’t want to go back to tracking each dollar spent in a spreadsheet and pulling my wife over to yet another service is unlikely to be a fruitful endeavor. So.. I complain to you internet! If you’ve had something similar happen, I’d love hear about it.

2025 Playlist Observations (Weekly Roundup 1/2/26

I really enjoyed making a few observations last year on my 2024 Spotify playlist. I felt like it would be fun to continue that tradition(?) this year as well!

I would say compared to last year, my tastes have been a lot more all over. The first quarter of the year was very skewed toward my typical indie/folk tastes. I found several songs that I listened to year through the whole year, especially Never Been Better by Ben Abraham, Weird Goodbyes and This isn’t helping by the National.

As we got into the mid year, OK Go was basically all I listened to and watched. I’m not going to link to everything, but with the release of their latest album I was hooked. The video for A Stone Only Rolls Down Hill got the ball rolling and Love kept it going.

After that was Rouge Valley! Again this so heavily dominated I couldn’t possibly link to everything, but I listened through their whole catalog and enjoyed most of it! Their style is very unchanged in the Americana side of things if you want to give them a listen.

The last half of the year was a huge mix. It was lacking in big album releases that got my attention, and so the year is a healthy mix of Americana, Indie, a light touch of rock (several songs on the most recent Goo Goo Dolls album were fun). I also enjoyed a few longs off of Zac Brown Bands latest album. As he continues to lean more into the stoner persona I can’t really recommend the album, but there are a couple of nuggets What You Gonna Do comes to mind.

I’m excited to see what the next year brings, my current favorite band The Arcadian Wild is due for new music, and I can’t wait to see what singles (or hopefully full album) they release!

Leftovers and Reflections (Weekly Roundup 12/20/25

As the year draws to a close and the everyone slowly winds down into perpetual time off, I come to the end of the week without a lot that’s “new.” This seems like a great time to package in some random thoughts and reflections.

- I have probably mentioned it before but hitting my income goal was extremely fulfilling this year. After really committing to going all in my business has really bloomed. While my average loan size increased substantially, my units have largely stayed the same. My goal next year is to focus on the latter.

- I’ve witnessed my entire working team step up this year along with me. I look at the effort across the board and everyone’s numbers are up. It’s a beauty to behold!

- Family, it’s been a year with my new baby girl! She’s been such a light to our family. Seeing how she changes the mood of everyone in the house, especially my oldest, just melts my daddy heart.

That will be all for this week. I may take a break for the holidays and come back strong for the New Year… or I might do another round up next week! As my wife’s family likes to say.. “Maybe, maybe not!”

Updated App Defaults December 2025

It’s been a year since I’ve last written about my defaults apps. A year in and several categories have changed so it feels like a good time update my list!

- 📧 Mail Client: Outlook (personal) and Gmail (work)

- 💽 Mail Server: Outlook (personal) and Gmail (work)

- 📝 Notes: Obsidian (for blog stuff), Apple notes (personal), Google Keep (work)

- 📋 To-do: Reminders

- 📷 Phone photo shooting:

Camera Control ~80% of the time, swipe left from lock screen otherwiseCamera Control to launch the camera - 🎞️ Photo Management: Photos.app

- 📆 Calendar: Calendar.app (personal), Google Calendar (work)

- 🗃️ Cloud File Storage: OneDrive and iCloud Storage

- 📖 RSS: Reeder

- 📇 Contacts: Contacts.app

- 🛜 Browser:

Vivaldi(personal), Edge and Chrome at workSafari (personal), Chrome (work) - 🗣️ Chat (not messages):

discord mostly, some telegramDiscord - 📑 Bookmarks: none

- 🔖 Read It Later: none

- 📜 Word Processing: Rarely used, but Word when I do need something for this

- 📋 Spreadsheets: Rarely used, but Excel

- 🛒 Shopping lists: Reminders.app

- 🏞️ Presentations: none

- 🍱 Meal Planning: None

- 📈 Budgeting and personal finance: Simplifi

- 📰 News:

mostly google, or sometimes Apple news for headline stuffnothing - 🎧 Music: Spotify

- 🫛 Podcasts:

CastroOvercast 🙌🏻 - 🔐 Password Management:

1PasswordPasswords.app

Date Night! Weekly Round Up 12/13/25

This week was really special! My wonderful in-laws watched the boys over night so my wife and I could have a date night and date… day? We haven’t gotten to go out and eat a nice dinner in quite some time, so I’m grateful for the time spent! Georgia was a very sweet third wheel as we ate and ran some errands. On to the roundup!

- Marques has been making the rounds! This week he was interviewed on the [[Cortex]](https://overcast.fm/+AAE7b5rHjjopodcast series State of the Workflows. It was a fun dive into apps that keep the MKBHD empire moving.

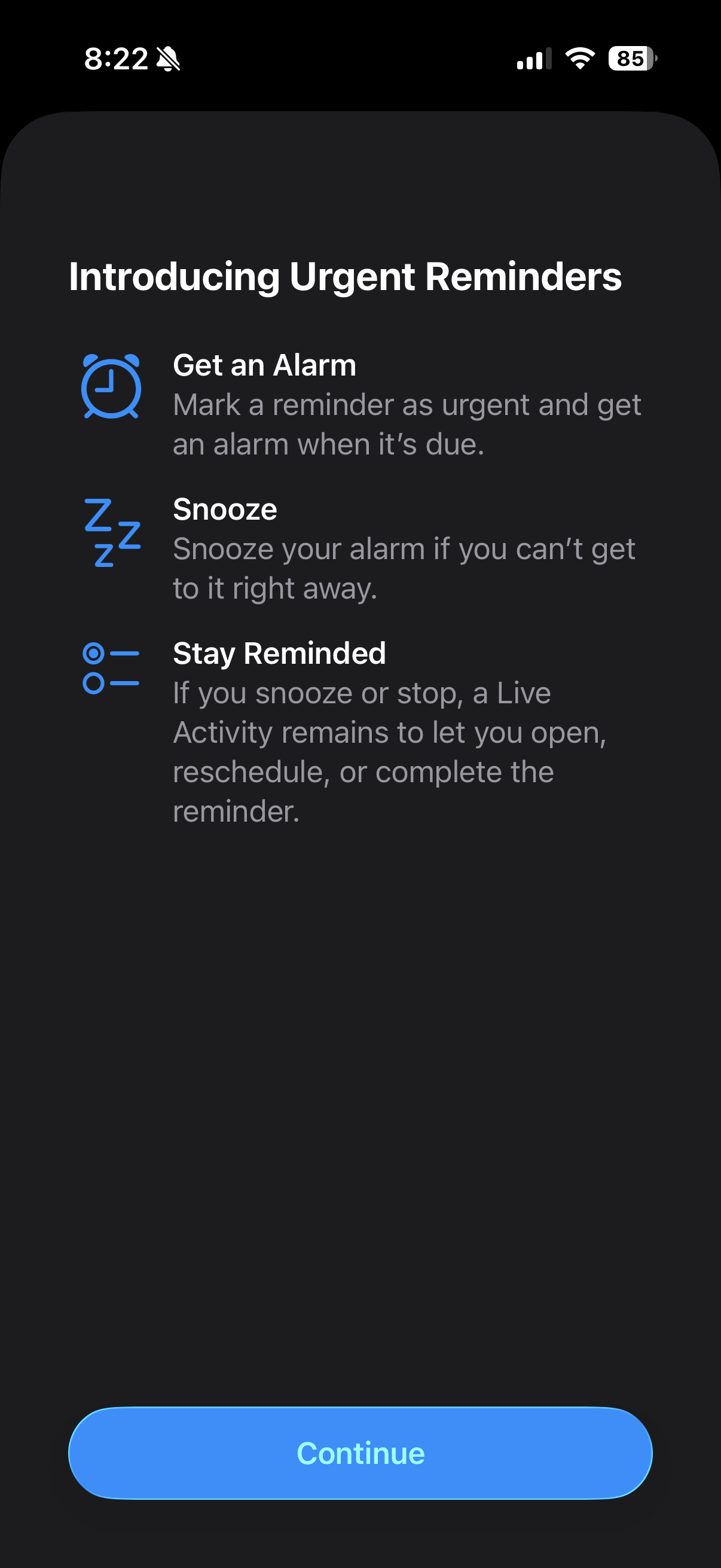

- The various OSes 26 received a .2 update this week. The main thing that I’ve noticed this adds is some really exciting improvements to the reminders app. Reminder snoozing, alarms and persistent notifications were all added in. Excellent quality of life improvements for those of us rocking the default reminders app on Apples platform.

Music Old and New - Weekly Roundup 12/6/25

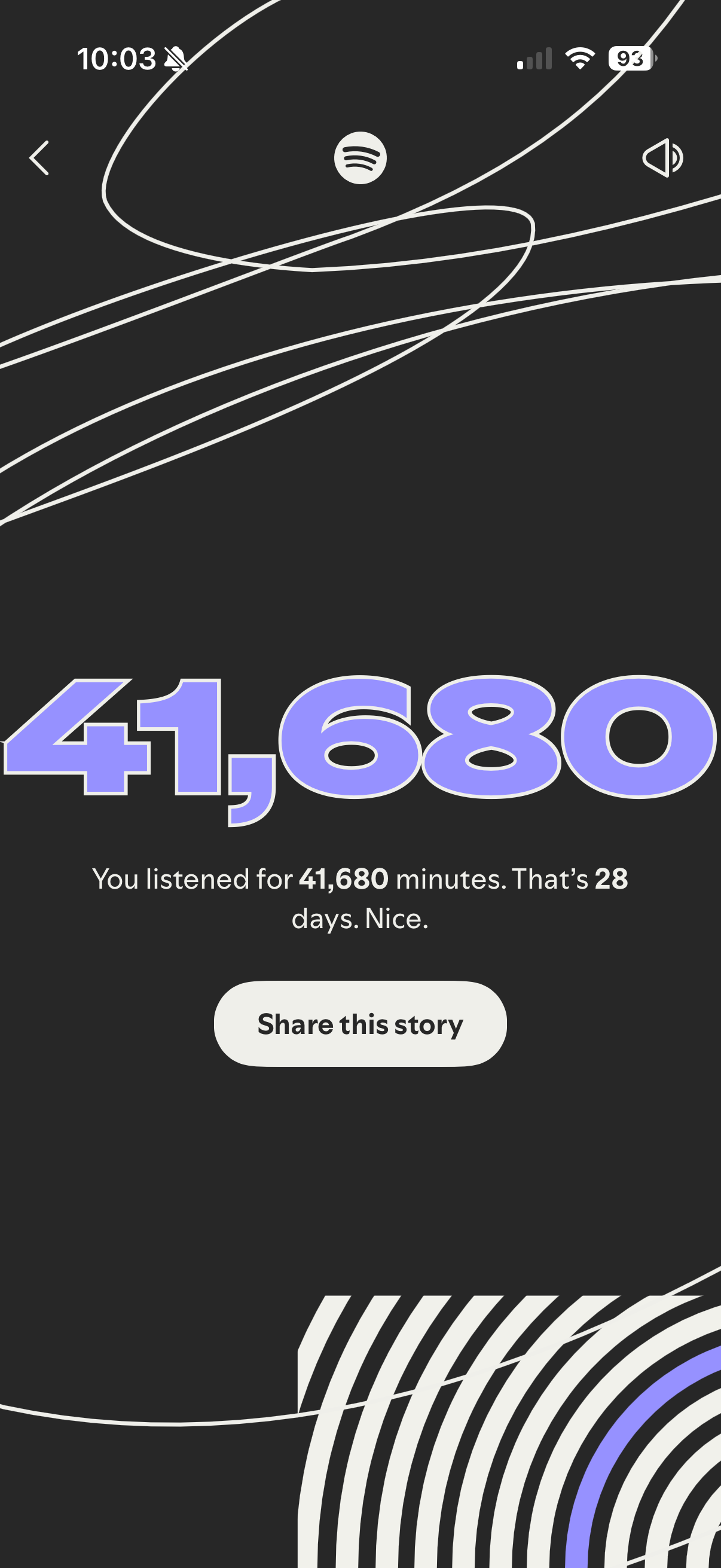

It’s Wrapped week! It seems the internet has been buzzing about all their various data being repackaged into fun graphics and insights. As someone who loves data, this never stops being fun to me as well.

- First up it’s YouTube recap! It was great to see YouTube jump on this bandwagon. YouTube premium is the only “streaming service” I am making consistent use of these days. The insights here were pretty cool.

- Next is the OG! Spotify has been doing this the longest and they do the best job at packaging the data in interesting ways. My top artist was the Corner Room which isn’t terribly surprising. I did find some new artists and I listened to a lot of music in general… forty one thousand minutes worth 👀

Weekly Update 11/29/25

On this Thanksgiving week I am so appreciative for a lot of things!

- My little girl just turned a year old. While she doesn’t sleep particularly well at night, she is happy and healthy and such a positive little light in our family. Never have I seen so much personality in such a tiny package (and my boys are no slouches when it comes to personality).

- I’ve said it a couple of times here, but I am so grateful for a good year in mortgage. Going all in has made such a positive mental shift for me. While I haven’t stuck with posting on Facebook/Insta I have kept fairly consistent with posting to my blog and taking ownership of my business.

- I really enjoyed this week’s bonus episode of Waveform. One of my favorite YouTubers (Michael Fisher) who was covering Windows Phone back in the day interviewed my all time favorite YouTuber (Marques Brownlee). It was excellent hearing 2 pros talk shop, and the ethics of “taking down” bad companies with bad reviews.

- This one is a bit in the weeds, but Spotify’s new Listener Statshas been an interesting insight into my listening habits. While on its own that might be illicit a response of “hm neat I guess” what elevates this a bit for me is the suggestions under that week’s listening. I clicked through a few of the suggestions and all but one of them were excellent! If you’re a Spotify user and you like finding new music, this one may be worth a few clicks for you.

See you in… December 👀

Weekly Roundup 11/22/25

This week will be a little different! I don’t have a specific recommendation, instead I wanted to share a few thoughts on the M3 iPad Air I got for an early Christmas present.

Previously I had the 2020 iPad Air. I used this device extensively at work primarily for customer contact and occasionally for meeting notes. Even 5 years later that device has served me well. The biggest problem was that I had foolishly opted for the 64 gb model. Anytime it was time for an update I had to start culling apps. In short, it just wasn’t working for me any more.

Enter the M3 iPad Air! This time I went with 256 gb and a color that could arguably be described as “blue.” It is a very happy time looking at the storage tab in settings and only be filling it up 1/3 of the way. While that was an expected outcome, I wasn’t prepared for much snappier the M3 was vs the A14 that was in my previous model. Everything feels so much better! What Apple is continuing to accomplish with the M series chips is incredible. When I stop and think that this model is 2 generations behind what’s current I’m even more impressed.

This isn’t a full review as I’ve only had the device a couple of days, but if you’re considering an upgrade into an M series iPad, you too will likely feel the improvements!

Weekly Round Up 11/15/25

This was a week mostly dominated by sickness. A mild bug has made its way through the kids and Steffani. It has missed me… so far, but I’m sure my time is coming 😅. The recommendations are a bit limited as a result. Side note, I never intended this roundup to be so dominated by music. Especially Christmas music, but there has been some solid new releases and my Christmas playlist was feeling a bit stale so I’ve been excited to add new music to the list!

- My first recommendation is Brad Paisley’s new album. It’s been a long time since he has released any music and his last album was pretty meh for me. I love to see his songwriting humor shine through. I was smiling from start to finish on my first listen through. My favorites are the more sentimental tracks of Snow Globe Town, The First Noel and O Holy Night.

- My favorite Christmas album in a long time comes from The Corner Room however. Their whole “thing” is to set the Scripture to music, and they’ve been doing it for years. The latest album follows their continued excellence. Every song is a great listen with my favorite being John 8:12.

Weekly Update 11/8/25

As we keep on marching forward into what is traditionally the “slow season”of mortgage, I’m nearing my most applications generated in a rolling 30 day period. God has really blessed this year!

- Follow up from last week, I rolled credits on Triangle Strategy! Apparently there is some golden path to get the true ending, however I’m not a big fan of advertising choices that matter and then having only one path to a true end. I still love the game though and I may revisit it again to get the true end. That final battle was intense, I was down to just my spy surrounded on all sides. My take cover ability was the only reason I was able to win 😎

- Another Christmas song from Pentatonix! They have done Silent Night before but this version with the King’s Singers is exceptional!

- Gabz has some great thoughtson sticking with known quantities when it comes to tech. I have similar feelings of not wanting to make big moves when my own work flows and family patterns are established (and entrenched).